Emmi + FactSet Announcement

Hello everyone,

Apologies for the hiatus in posting to Carbon Alpha, but as the co-founder of Emmi, I am thrilled to announce today that we are launching globally with FactSet, a leader in financial data and investor analytics. 🎉 🎉 🎉

This is a step-change towards our mission to mobilise capital towards Net-Zero and culminates in all our public equities and fixed income climate analytics being available on FactSet workstations as of today.

In today’s newsletter, I wanted to share a little context of our journey so far and what the new collaboration means.

Carbon to be part of every financial decision

Carbon emissions are embedded within every transaction in the economy. After +20 years as a climate scientist analysing the flow of carbon around the world, I've learnt that decarbonising the world’s economy will never be achieved by a few energy breakthroughs or technologies (sorry Elon).

The first and most important step to achieve a low-carbon economy is to integrate the cost of carbon into every financial decision.

That way, we can unleash the power of capitalism to efficiently allocate resources in a way that accelerates decarbonisation. But how do you quantify the impact of carbon across complex financial markets?

Climate analytics from traditional financial data vendors had limited coverage with methods that were crude, opaque and inflexible. So when we founded Emmi back in 2019, the goal was to fix this by building the world’s most advanced climate risk analytics that is backed by science, flexible and covers all asset classes.

Three things were needed to make this vision happen:

1. Financed Emissions Coverage

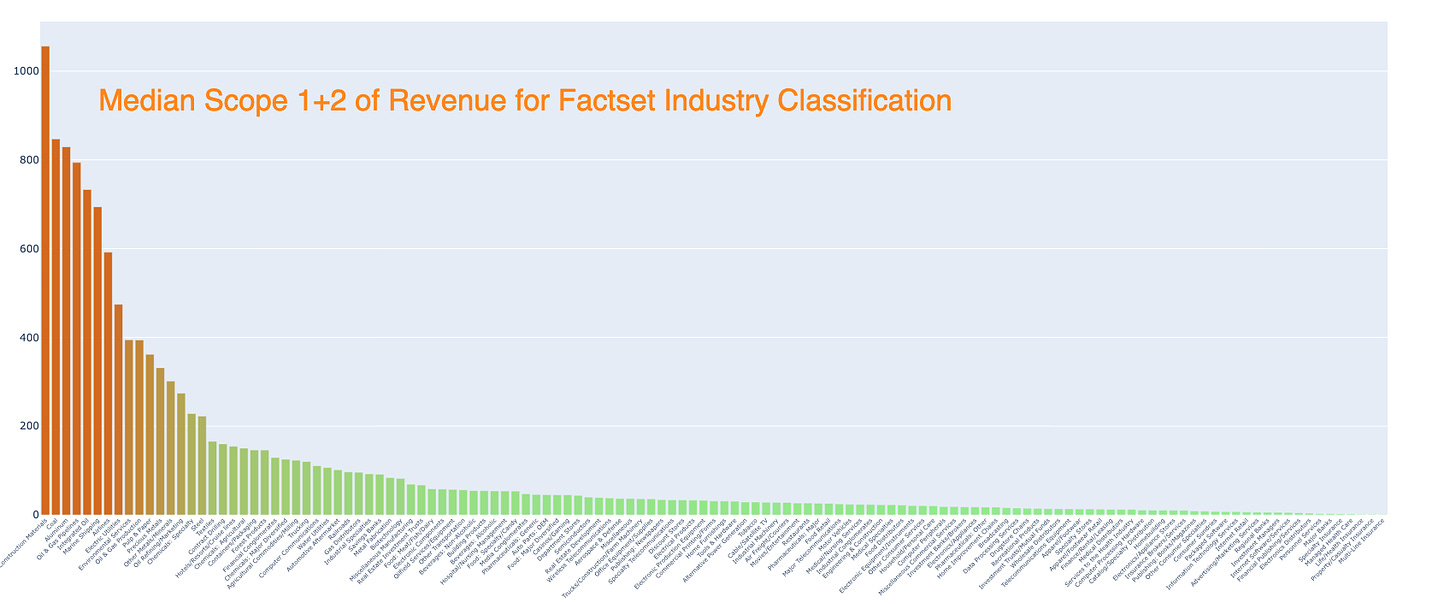

We collaborate with leading climate financial researchers to have built award-winning machine learning models that deliver robust, accurate and timely emissions data to fill the gaps across complex financial markets. Unlike others, we take an open scientific approach, publishing our methods in peer-reviewed literature and disclosing the uncertainties.

2. Carbon Risk Algorithm

Using decades of expertise, we have built what we believe to be the most comprehensive, yet flexible carbon risk algorithm that can incorporate any climate scenario and future carbon pricing down to virtually any asset or holding. This allows investors to understand the financial impact of their holdings from climate and take actions.

3. Carbon Risk + Scale

The final piece we needed was scale, which our new FactSet partnership provides, delivering our climate analytics to the global market.

What This Collaboration Means

Factset has a large global network of financial customers who can now integrate our climate risk analytics directly into their FactSet workstation and portfolio analytics tool. The main benefits include:

Easy access to our high-quality, actionable data to navigate the complex landscape of climate risk

No more needing to navigate multiple data vendors or deal with the hassle of integrating disparate systems

You can now streamline your climate risk assessment, management, and reporting processes.

What’s Next?

This partnership is helping pave the way for a future where carbon is integrated seamlessly into investment workflows—offering actionable insights that not only meet today’s climate demands but also prepare them for tomorrow’s low carbon world.

With the first part of the integration complete, I will go back to sharing research insights in future posts.

In the meantime, thank you for being part of our journey. We’re just getting started.

Until next time.

Ben