Hello everyone,

Carbon pricing, whether formal or informal is expanding. A new analysis from the World Bank shows there are now 73 Carbon Trading Schemes or carbon taxes across the world covering 23% of global greenhouse gas emissions. In reality however, a shadow carbon price is already in-effect at least in the advanced economies, with consumers heavily shifting away from high-carbon producing goods.

So what’s the best way to quantify the impact of a carbon price on your investments? In this newsletter I wanted to share our methods at Emmi using a fictional company to help..

If you want to see a real-world example of a company to see every stage of this methodology played out, we can walk you through a publicly listed company as an example. Get in touch with us here or just reply to this post.

Acme Steel Inc.

Acme Steel is a 6,000 person manufacturer, based in Australia. OK, so what are the steps needed to understand their current and future carbon liabilities?

1. Estimate their carbon footprint

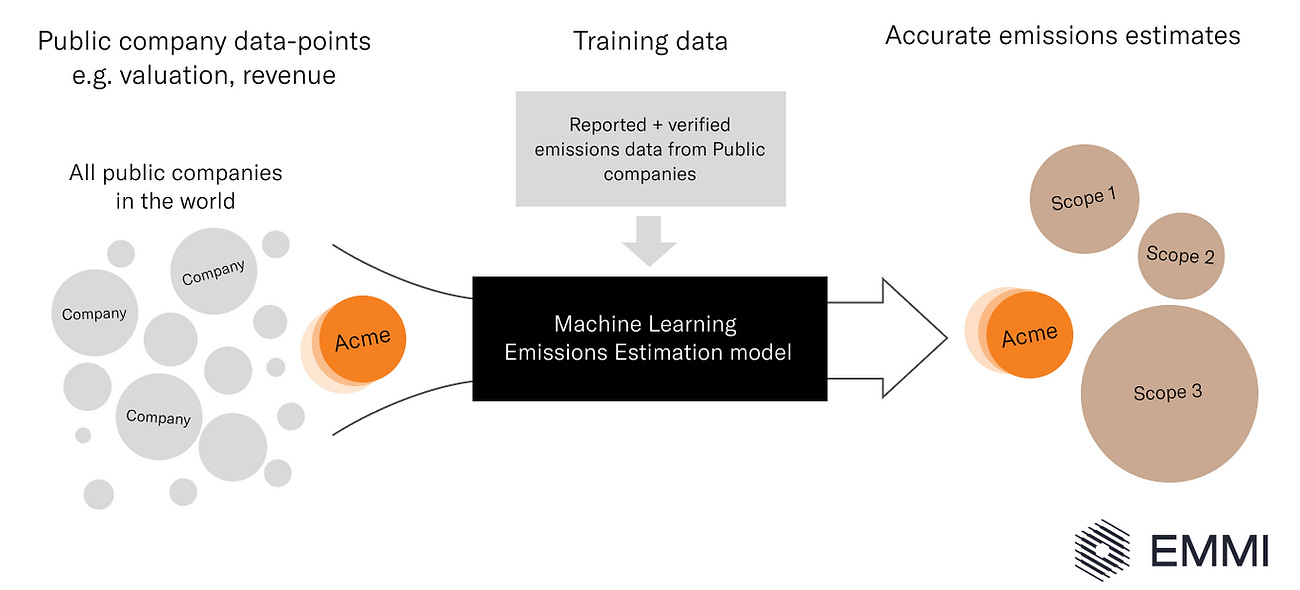

Like 90% of the market, Acme haven’t yet reported their carbon emissions - so we can estimate their emissions via their business metrics, like revenue and geography, to predict Scope 1, 2, and 3 emissions. We do this using Machine Learning. Our models are trained on 6,000 public companies that have reported and verified emissions, which can then be used for any company in the world. You can read more how we do that here.

Acme Inc. has $10billion in revenue, is based in Australia within in the Materials sector with a capital expenditure of $500million and net property, plant and equipment value of $4billion. Based on these factors, Emmi estimates it has 8.6million tonnes of Scope 1 emissions, 1.5million tonnes of Scope 2, and 14.3million tonnes of Scope 3 emissions for the year 2023. In total, a footprint of 24.4million tonnes.

2. Allocate carbon budgets from climate scenarios

We need to quantify Acme's carbon budget for today and the future. We'll use the IPCC's 1.5°C scenario (Net-Zero emissions by 2050). How do we allocate global budgets down to each company for that scenario?

2.1 Assessing a companies carbon efficiency relative to the world

Apple, the company, emits 30million tonnes of carbon each year, similar to Porsche. But Apple is 25 times larger financially. To fairly distribute carbon budgets, we need to quantify a company's carbon financial performance relative to global budgets for a scenario.

We assess a company's carbon efficiency through five factors: Revenue/Carbon, Market Capitalisation/Carbon, Enterprise Value/Carbon, Assets/Carbon and Net Assets/Carbon. Acme's efficiency is then benchmarked against the global carbon efficiency requirements using GDP, Global Wealth and Global Debt.

For example, Acmes Scope 1 carbon efficiency of revenue is $1,163 per tonne of carbon. The global benchmark for a 1.5°C scenario is $3,571 (GDP/Global carbon budget). Since Acme's rate is lower, they need to increase the amount of earnings per ton to avoid penalties for being above the 1.5°C scenario budget. They need to reduce their emissions by 67% to be at the "on-budget" ratio. We calculate this for the same 5 economic factors across Scope 1, 2 & 3 to gain a comprehensive understanding of the company's reduction requirements.

When considering reductions requirements in the context of potential carbon liability, we ignore any efficiently performing emissions scopes to void any upside for assets that could emit more because they are currently tracking underneath the carbon budget. We focus on risk of not reducing, not reward for increasing emissions to match a budget.

2.3 Assessing a companies financial resilience to carbon costs

Assessing a company's carbon efficiency is an important first step, but it doesn't tell you if the company can withstand new carbon costs. The next step is to understand when carbon costs significantly erode the value of the company, or carbon resilience.

To assess this carbon financial resilience we consider 7 other factors:

Adjusted EBITDA vs EV multiple, to assess Enterprise Value erosion as a result of new carbon costs

Adjusted earnings to Price earnings ratio, to assess Market Cap erosion as a result of new carbon costs

Dividend erosion, to assess the asset’s continued ability to pay dividends with new carbon costs

Debt to EBITDA, to assess the asset’s continued ability to service it’s debt with new carbon costs

EBIT coverage ratio, another way assess the asset’s continued ability to continue to service it’s debt with new carbon costs

Assets to liabilities, to assess the asset’s ability to pay it’s liabilities with it’s assets with new carbon costs

Cashflow from operations , to assess how effected the asset’s cashflow would be with new carbon costs

We combine the 5 carbon efficiency factors and 7 financial resilience factors into one emissions reduction number and carbon allowance for any given climate scenario which gives a comprehensive measure of the budget and reductions needed for a company to avoid financial downsides from new carbon costs.

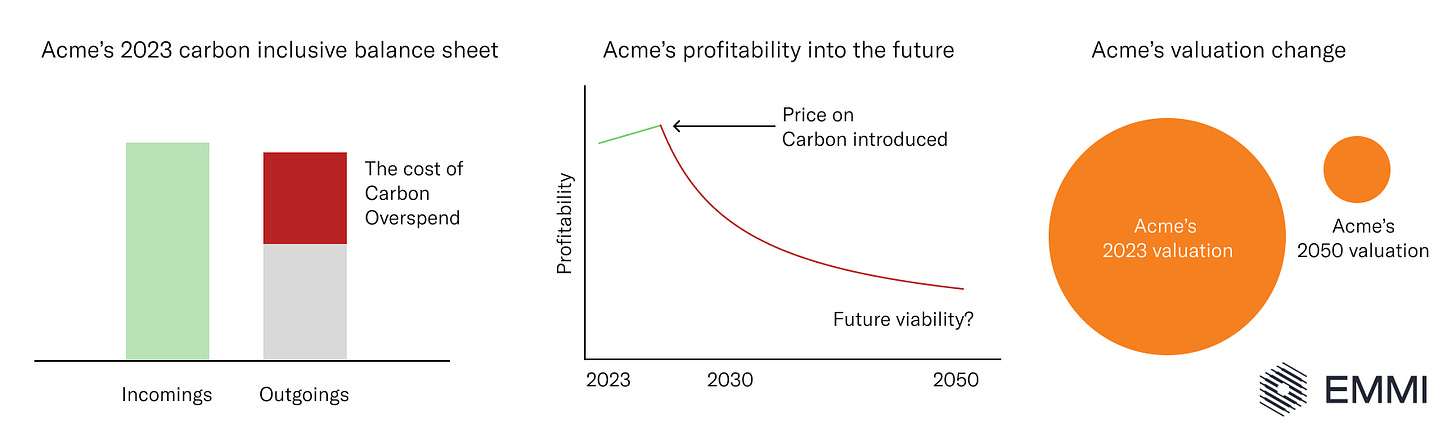

3. Calculating the carbon ‘over-spend’

We now have the allocated company carbon budgets for the 1.5°C scenario until 2050, which allows us to calculate the carbon gap or ‘over-spend’ which is done by subtracting allocated budgets from todays actual emissions (assuming no change). Subtracting their total emissions of 24.4million by their allocated carbon budget of 15million tonnes, means they have a ‘Carbon overspend’ of 9.4 million tonnes CO2e for 2023. These are the emissions that will incur a carbon price under that scenario, creating an annual cost and value erosion over time. Projecting today's emissions estimates into the future reveals how this gap widens over time.

4. Using carbon prices to calculate the carbon liability

For any future climate scenario, there is an associated carbon price. These carbon prices are then applied to the Carbon Overspend in order to answer this question: How much of a companies value, in todays terms, is eroded if there was a price on Carbon for a given scenario?

Given Acme has an overspend budget of 9.4million tonnes, the $145 carbon price implies a carbon liability of $1.363billion in 2023. This annual carbon cost will hit the bottom line, so we deduct it from the companies operating performance or EBITDA. So Acmes carbon-adjusted EBITDA is $1.6b - $1.363b = $0.237billion.

We use an EBITDA multiple as a quick way to re-value a company today or into the future. This is a financial ratio that compares a company's Enterprise Value to its annual EBITDA - for Acme that would be $8.2b/$1.6b = 5.125. So their new 2023 Enterprise Value would be expected to be $0.237b x 5.125 = $1.21b. In percentage terms, this equals (1 - 1.12/ 8.2) = 85% erosion of EV in 2023. This is the percentage value erosion reported as Potential Carbon Liability.

In 2030, the carbon price for a 1.5°C world has increased to be $218 per tonne while their fair-share carbon budget allocated has reduced to be 10 million tonnes. Without any changes to Acme’s emissions (24.4million tonnes), their annual carbon cost is $3.14billion in 2030, reducing their carbon-adjusted EBITDA to zero and effectively eroding the entire Enterprise Value of Acme due to carbon pricing.

NB: As an investor, you own a portion of the company, so the above calculations need to be scaled with financed emissions using your weight allocations across your portfolio, then aggregated at the portfolio level to quantify your total carbon liability at the portfolio level

The importance of scenario analysis

The future is uncertain and carbon prices could bite quickly or be gradual. To understand the impact of carbon on your investments, stress-test them across possible future scenarios. This will help identify potential downsides and whether targets are achievable.

What would happen to Acme in a 2°C world or one with delayed transition? What happens when sectors get different carbon budgets? Or what about different asset-classes? How does fixed-interest, infrastructure or sovereign assets get impacted by different climate scenarios and prices? That is where Emmi helps by providing you to quantify a range of future scenarios and prices to your investments. Reach out if you want to find out more on how we can help.

Until next time.

Ben

A steel company is an interesting example. Steel and cement/aggregates are carbon intensive - but vital ingredients run a modern industrial economy. Setting a carbon efficiency of x dollars of revenue per ton of co2 disadvantages some vital, necessary industries (steel/cement) in favour of other industries (tech). Should carbon budgets be different for each industry? If they are not then we disincentive the production of steel or cement in western countries where these metrics are tracked and transfer to other countries (China) where carbon emissions are likely higher. Also introduce issues with respect to supply chain/national security risks which need to be balanced against climate risks.