New Carbon Disclosure Mandates: Why banks are set to be hardest hit

Hello everyone,

As COP 27 kicks off in Egypt, quantifying the impact (and therefore financial exposure) a business has on climate is changing globally. New climate disclosure rules that include Scope 3 emissions are in law or planning to be across the developed world. This has big implications if you’re a bank or financial institution.

In todays newsletter, I want to share some data-driven insights on the magnitude of Scope 3 emissions for banks and financial institutions, the state of disclosure for the largest 200 banks and some challenges ahead.

Corporate Carbon Disclosures: Refresher

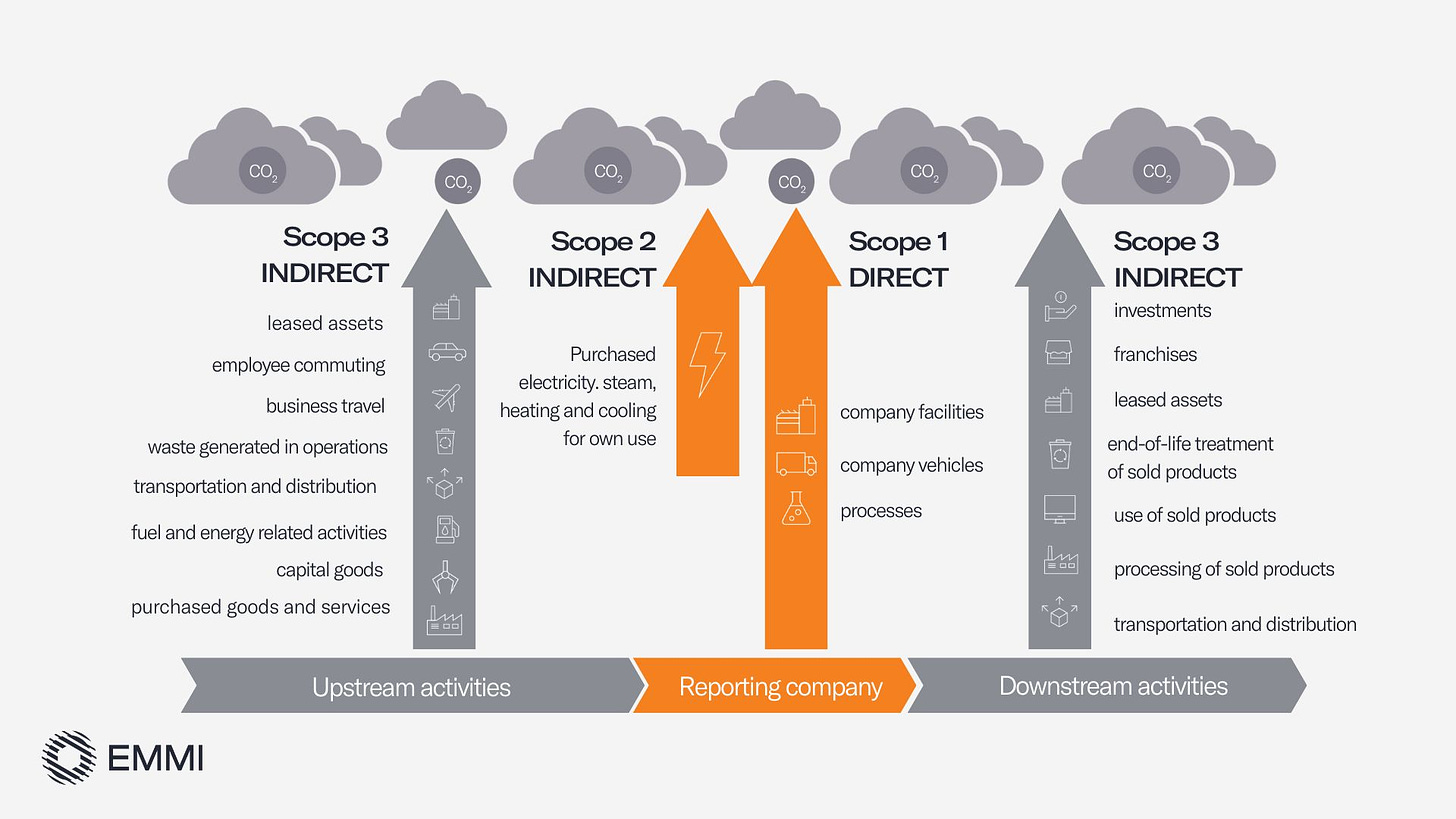

For corporate climate disclosures, authorities have traditionally only cared about Scope 1 & Scope 2 emissions (eg. emissions created via use of buildings, vehicles and electricity). However authorities across the developed world are increasing mandates on company climate risk disclosures that go upstream and downstream emissions for companies.

Known as Scope 3 emissions, there are 15 different categories (see chart above). They include emissions created from upstream activities like purchased goods, business travel and employee commuting - to downstream activities like processing/use of sold products and investments.

We recently analysed Scope 3 emissions disclosures globally with the University of Otago and found that over 70% of global Scope 3 emissions exposure come down to just 3 categories - ‘processing of sold products’, ‘use of sold products’ and ‘investments’. So in general material Scope 3 carbon exposure generally comes to companies that produce, export or finance a carbon-intensive product.

For example , oil & gas companies Scope 3 emissions are dominated by ‘use of sold products’ when millions of consumers startup their cars or turn on their gas-stoves. Since the product is carbon-intensive, oil companies have a material Scope 3 exposure of billions of tonnes.

But what about the financial industry? What’s the magnitude of Scope 3 when finance is the product?

What are financed emissions?

When a financial institution issues investments and loans through a financial product, it’s the Scope 1 & 2 emissions of their customers that make up the vast majority of their Scope 3 emissions exposure (see chart below1). This is known as financed emissions or ‘investments’ in the down-stream Scope 3 category.

Although there are 14 other Scope 3 categories for a financial institution (see chart above) - they are all either negligible or not relevant. Yes, even business and employee travel is insignificant in comparison to their financed emissions exposure (more on that later). Financed emissions is therefore interchangeable with their ‘Scope 3’ when talking about a financial institution.

How are financed emissions calculated?

Quantifying financed emissions is complex, since financial institutions provide investments and loans to potentially tens of thousands of different companies and assets within their financial portfolio. And in reality the vast majority of those investments have no carbon data. Even in listed equities, we know that just 10% of the 55,000 companies report their annual carbon emissions globally. For the millions of unlisted companies, carbon reporting is non-existent.

From fixed income products, infrastructure assets, mortgages and project finance, you can see how complex quantifying financed emissions is for a financial institution. Because of this, our research found just 9% of financial institutions disclosed their financed emissions by 2019. Even for those who have disclosed financed emissions, data gaps and incomplete coverage is also the norm, with some disclosures covering only a fraction of their exposure.

Latest financed emissions disclosures

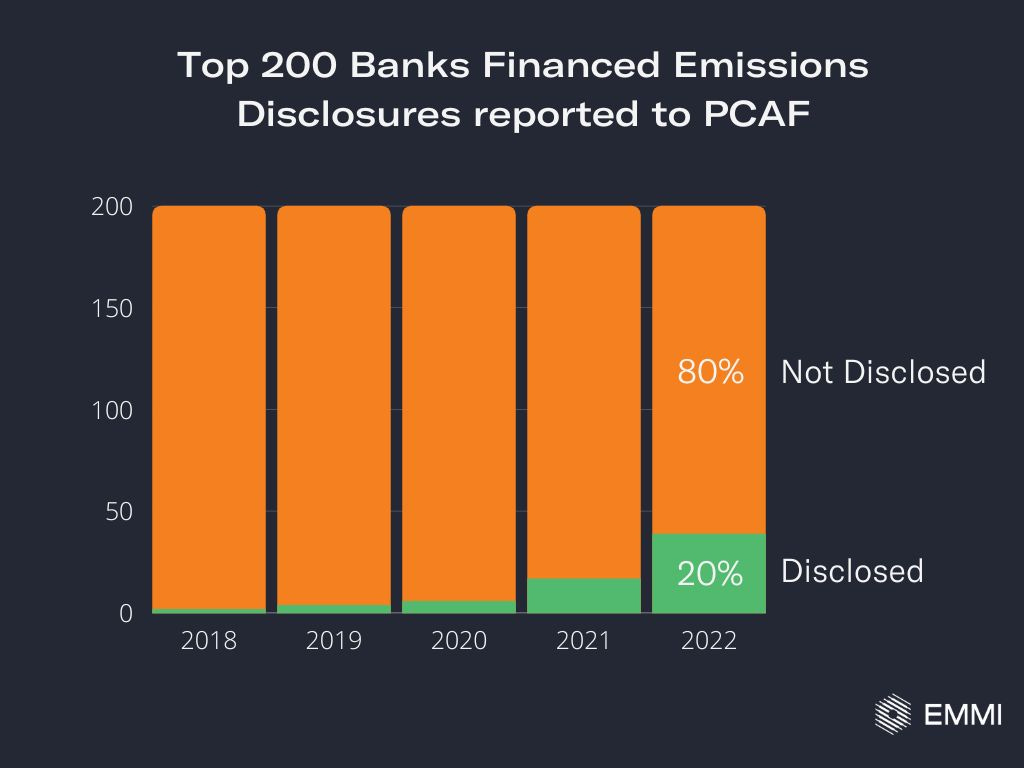

Due to the complexity and importance of understanding the magnitude of financed emissions for financial institutions, the Partnership for Carbon Accounting Financals (PCAF) was recently formed to help provide guidance and standards for financial institutions to assess and disclose greenhouse gas emissions of loans and investments.

PCAF provide ongoing methodologies and a database of financial emissions disclosures for financial institutions. I took the world’s largest 200 banks and compared it to the PCAF disclosure database.

The vast majority of big banks (~80%) have not yet disclosed their financed emissions. However we can see a big trend in disclosures during 2022, with disclosures more than doubling over the past year.

What’s a typical financed emissions footprint for a bank?

It’s encouraging to see banks taking on the task of quantifying financed emissions. Of the banks who have disclosed their financed Scope 3 emissions under PCAF, the majority have so far disclosed a fraction of their portfolios. The largest banks have focused on estimating their financed emissions in carbon-intensive portfolios like oil, gas, power and auto. Because of this, it has been difficult to understand the scale of a banks total financed emissions footprint given those sectors make up a fraction of their total portfolio.

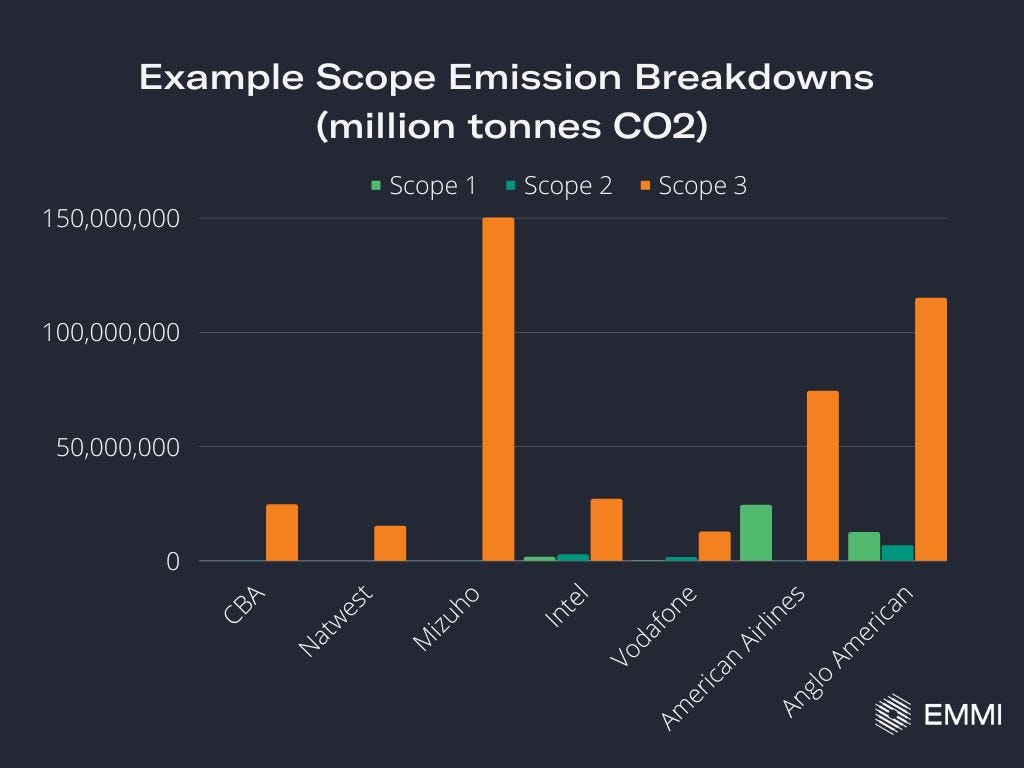

Three recent disclosures from larger banks however, give us much greater understanding and granularity for a typical banks financed emissions:

UK bank NatWest disclosed financed emissions that covered 52% of its total on-balance sheet gross lending and investment exposure.

Australia’s largest bank, Commonwealth just disclosed their first financed emissions covering 84% of its portfolio.

Meanwhile, the Japanese mega-bank Mizuho recently disclosed emission estimates for nearly all its over $2 trillion in lending and investments.

Using these recent disclosures, I’ve compared Scope 1, 2 & 3 footprints and compared them with some other equivalent companies across technology, airlines and diversified mining. You can see pretty clearly just how important financed emissions are to the total footprint for a bank - the operational footprints don’t show up, particularly in comparison to other companies in tech, airline or mining.

Taking into account financed emissions (ie Scope 3) for these larger banks makes them comparable in footprints to other large companies. For example Mizhuo’s financed emissions (~154million tonnes) are much larger than American Airlines total footprint (~100million tonnes) and even larger than miner Anglo American (~135million tonnes). These large financed emissions numbers for banks are expected given how important lending is to the global economy - which for now is carbon intensive.

Financial Institutions will be hit hardest with new mandates

As shown, financial institutions generally have very small Scope 1 & Scope 2 footprints relative to other sectors. If authorities only care about those operational-type carbon emissions, then financial institutions would have negligible emissions and financial exposure.

Scope 3 mandates change that. By lending or investing in other companies who do have carbon-intensive physical products via their Scope 1 & 2 emissions, they now have a much greater carbon exposure via their financed emissions. A good way to show this jump in potential carbon exposure is by comparing the footprint ratio of Scope 3 / Scope 1+2 across sectors.

For a big miner like BHP, the Scope 3 ratio is about 40x while for big tech like Amazon, their Scope 3 ratio is ~4. For banks and financial institutions however, their Scope 3 ratios are much higher at ~200x (for Mizuho Bank it’s ~900x). Inclusion of Scope 3 disclosures by authorities means carbon financial exposures would increase orders of magnitude (>200x) more than those implicated from just Scope 1 & 2.

What next for financial institutions?

Most banks haven’t yet disclosed financed emissions but are in the planning phase and are likely facing large carbon data gaps that limit their coverage. For the 20% of the worlds largest banks who have disclosed financed emissions, the challenge is to improve coverage, data quality, efficiency and scaleability that allow consistent reporting of financed emissions.

At Emmi we’ve built award winning machine learning models that predict emissions for virtually any company in the world to help fix data gaps and quality at scale. We’re helping a number of financial institutions with their financed emissions and transition pathways. If you are interested in talking to me and our team - just reply to this message or connect with me on LinkedIn here.

Thanks..

Ben

Under PCAF, Scope 3 of customers are also being phased in over the coming years starting with more intensive sectors like energy, oil & gas.