Hello everyone,

In my last newsletter I shared an analysis of what companies and sectors were most exposed to Scope 3 footprint mandates. Although emissions exposures can provide a guide - they don’t tell us anything about the financial exposure of those emissions. Including Scope 3 into climate mandates is something that is being debated by some regulators like the US SEC, whereas some companies are actively avoiding disclosing Scope 3 targets.

So what is the financial impact from excluding Scope 3 in climate transition risk? What sectors have a material financial liability from Scope 3 emissions? In this newsletter I investigate more with examples of Amazon and Airbus.

Scope 3 carbon liabilities by sector?

At Emmi, we calculate the climate transition risk for any asset across multiple different climate scenarios with our Carbon Diagnostics product. We can also include or exclude Scope 3 emissions (which some regulators are debating). For this analysis, I’ve run climate transition risk across all public companies including and excluding Scope 3 emissions under the IPCC Net-Zero scenario.

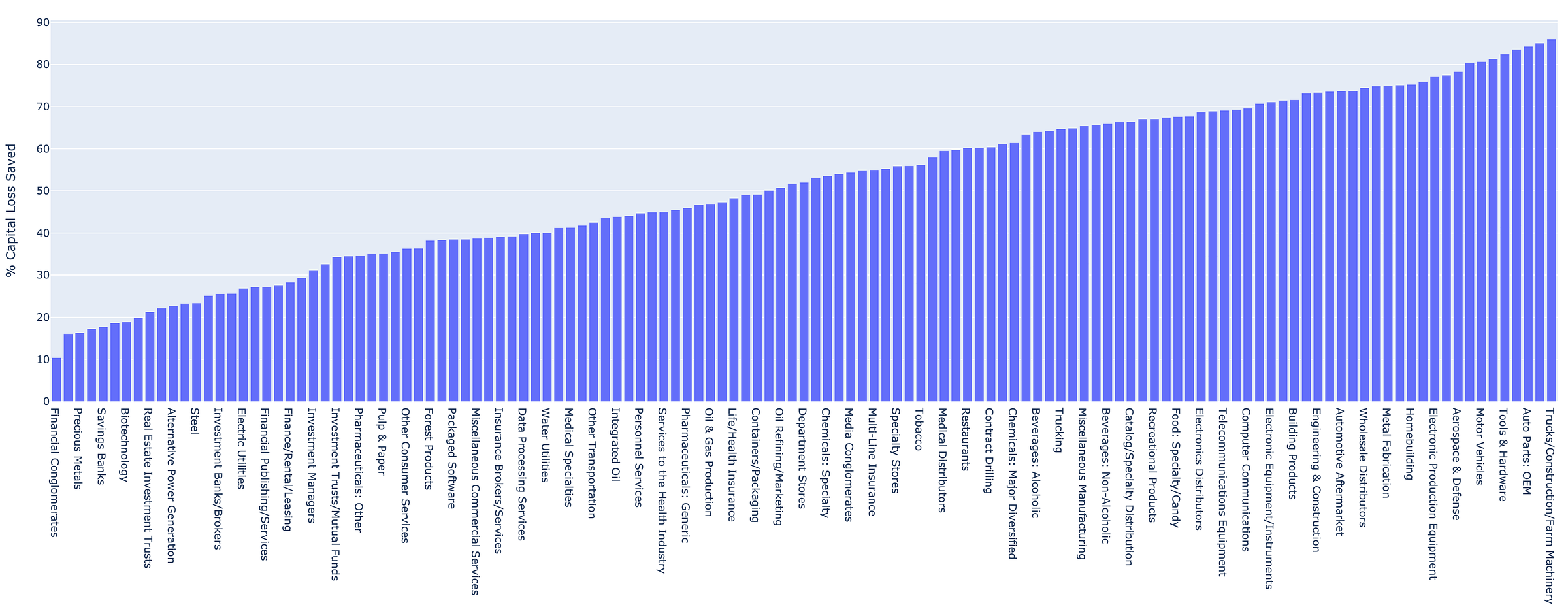

The differences are huge depending on the sector. To make it easier to show, I’ve calculated the average % of enterprise value by 2030 saved by not including Scope 3 carbon liabilities. So those companies with largest Scope 3 exposures as a function of their Enterprise Value save the most. Sectors like Motor Vehicles, Building and Construction and Airline Manufacturing with large Scope 3 exposures will save more than 70% of their Enterprise Value if Scope 3 is not included in climate transition risk.

On the other hand, Steel and Electric Utilities have far less to save by not including Scope 3, since most of their carbon risk comes from Scope 1 or 2 emissions.

You may be wondering why last week I showed that the Scope 3 exposure index was largest with the banks and financial institutions, yet above demonstrates the least savings when including Scope 3? This shows exactly why larger emissions footprints don’t necessarily translate to larger carbon financial risk. For banks, Scope 3 is by far their largest footprint, yet the financial risk as a function of their enormous enterprise value is low. That means even when including Scope 3, banks carbon transition financial risk is low relative to other industries.

Should Scope 3 be included for climate risk?

Scope 3 emissions are difficult to accurately measure while companies have little direct control over their reductions since those emissions occur upstream and downstream of a company’s products. However as carbon pricing and regulation get sharper, the market is shifting away from carbon intensive products towards lower carbon products/alternatives. So including Scope 3 is financially prudent to truly understand carbon risk.

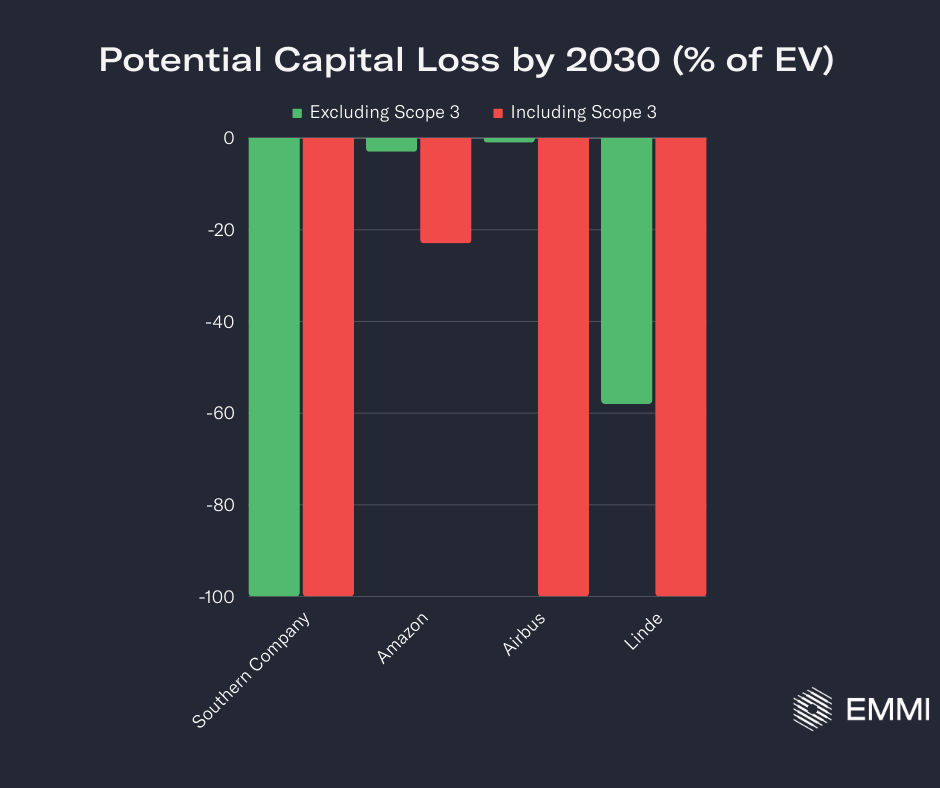

To demonstrate how important Scope 3 is, lets take the examples from my earlier newsletter using electricity utility Southern Company, aerospace manufacturer Airbus and chemical company Linde. I’ll include Amazon, a large consumer trade business for comparison too.

Using Emmi’s carbon financial risk models, by 2030 under IPCC Net-Zero, there are some huge divergences across those companies. For Southern Company whose emissions are particularly high in Scope 1, including Scope 3 doesn’t change their large financial exposure with 100% of their enterprise value being potentially eroded by 2030.

The largest impact is for Airbus, where virtually all of their emissions are Scope 3 - the downstream emissions from the airlines who create the emissions when using the Airbus airplanes. The change in climate risk goes from virtually no impact when not including Scope 3 - to a situation where 100% of their enterprise value is at risk when including Scope 3.

Omitting Scope 3 for Airbus doesn’t make sense because the carbon pricing/regulation will hit the Scope 1 of their customers (ie all the airlines). That will then theoretically cause a drop in airline demand for Airbus without a low carbon option - so including Scope 3 allows investors to capture that risk.

A company like Amazon, also has little climate exposure without Scope 3 - yet over 20% of their enormous Enterprise Value is at risk when accounting for their Scope 3 emissions by 2030.

Accuracy vs Materiality

Let’s not obsess over accuracy vs materiality. Measuring Scope 3 emissions doesn’t need to be accurate - it simply needs to be at a level whereby it allows a materiality check on their climate risk.

Even if Scope 3 emissions are >70% uncertain (yes they are), knowing those uncertainties still gives us the ability to assess the materiality of an assets climate risk. At Emmi we predict Scope 3 for all companies and know the uncertainty. That allows us to quickly and efficiently inform companies or investors whether they should invest into more accurate Scope 3 reporting.

Scope 3 doesn’t have a material financial risk for most companies, so they do not need to invest heavily into better reporting or consultants to measure their Scope 3. But for others like Amazon, Airbus and Linde - we find Scope 3 is hugely material in contributing to their future climate risk. They do need to invest into understanding their Scope 3.

Including Scope 3 emissions is critical for investors and regulators to provide more robust climate insights for decision-making, risk management, and sustainable investment strategies. However, to avoid lots of wasted resources, companies should only invest into measuring Scope 3 if they have a material exposure - since that is what the regulators require. How to do that in an efficient way?

If you are a company and want to quickly assess your Scope 3 emissions liabilities and whether they are material to your climate exposure, we are happy to help - just reply to this or contact me here.

Thanks for reading

Ben

Good thoughts (comment of a volunteer sustainable finance enthusiast)